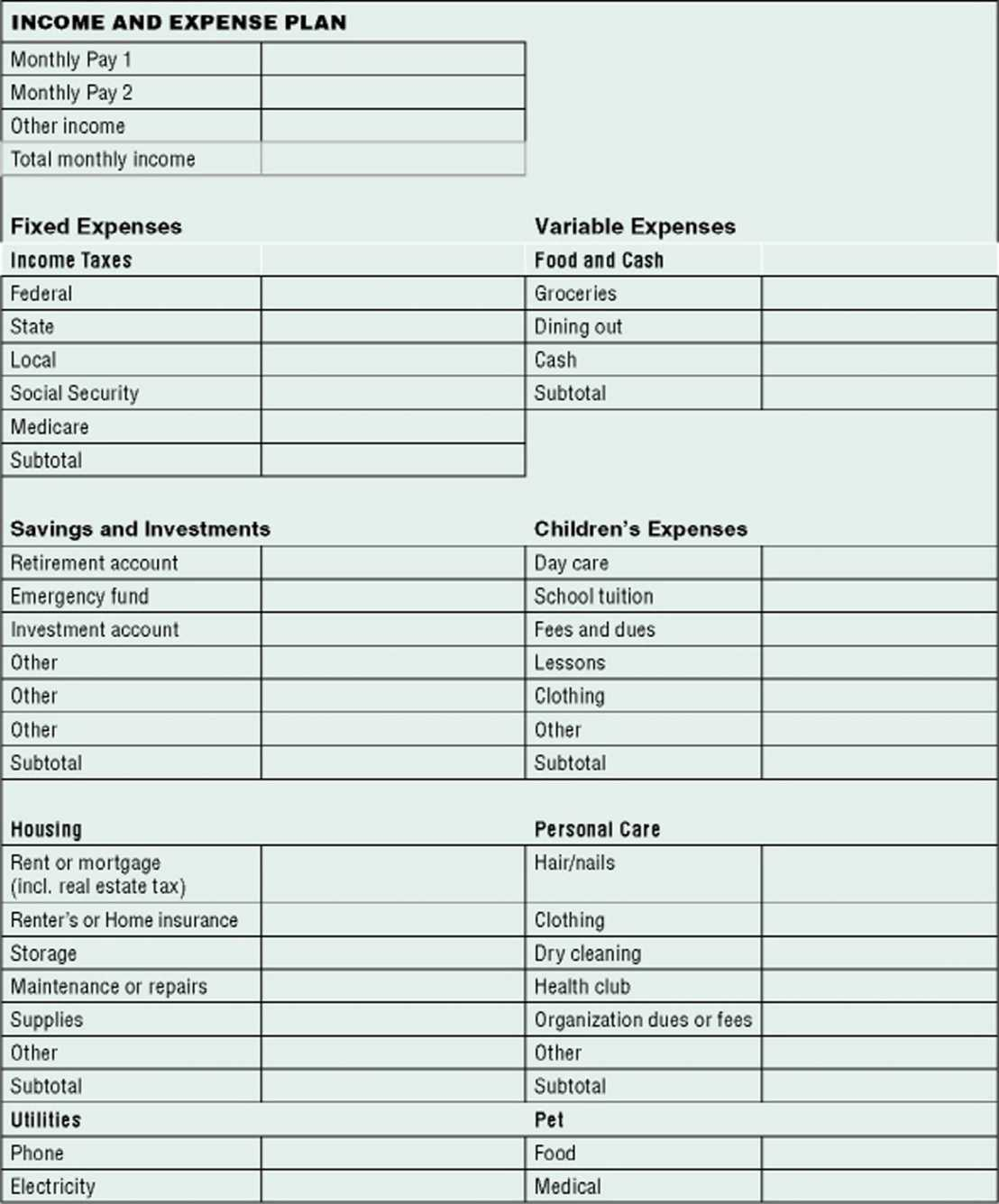

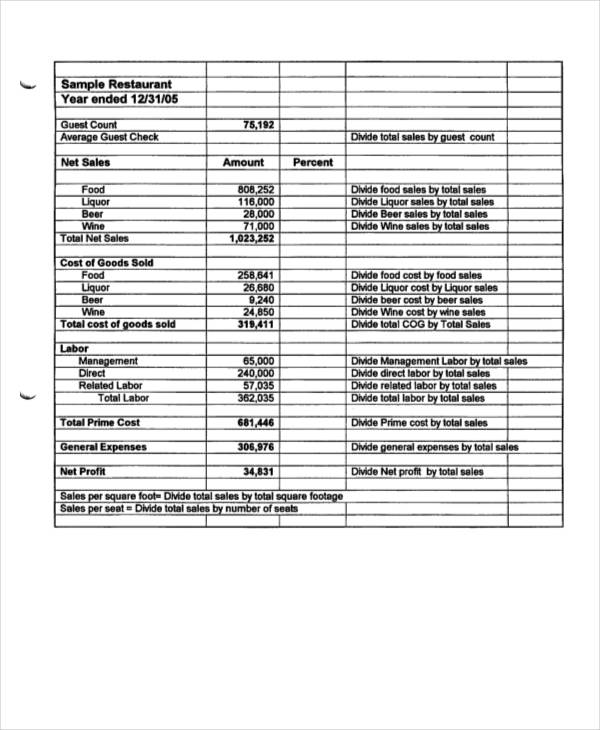

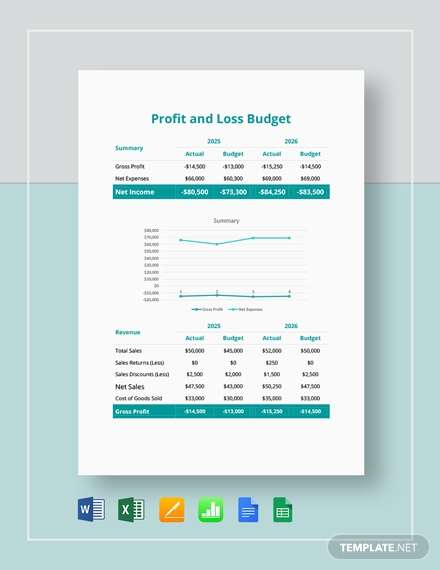

This number will show if you have a profit or loss after paying all your expenses. This is really the most important number of all, and the main reason for figuring out all the line items above. This type of income would include things such as interest or dividends from company investments, and expenses would be items like finance charges and interest paid on loans.Īdd or subtract these from your operating income, and you are left with your total pre-tax income, or your net profit. This would be money coming in or going out that isn’t related to the actual operation of the business. Step 6 – Adjust for Other Income and/or Expenses If you have costs you pay yearly, like insurance, divide them by twelve to get your monthly expense.ĭeduct the cost of overhead from your gross profit. Examples include expenses like rent, staff, advertising, equipment leases, and phones.

They don’t vary much from month to month or rise and fall with the number of sales you make. These are the fixed expenses you have to run the business. (Regular salaries are fixed expenses and will be figured in later.)ĭeduct the cost of sales (those variable operating expenses) from your total revenue to find out the gross profit of your operations for that particular time period.

These variable costs might include inventory, raw manufacturing materials, and additional staff you hired to cover a busy period. You might also see this referred to as the cost of goods sold. These are not your day-to-day fixed expenses (like rent, salaries, etc.), but rather the expenses that vary depending on how much business you’re doing. This will be your total operating revenue. As you are paid, enter and keep track of the figures. Revenue is the money you have received in payment for your products and/or services. If you use accounting software like QuickBooks, Peachtree or the like, the program will generate a P&L statement for you after you enter your sales and expense figures, but you can easily create your own using a basic spreadsheet and easy calculations, following the steps below. P&L statements can be done for any given period of time, but it’s helpful to review your P&L monthly or at least quarterly.

A profit and loss (P&L) statement will put all the numbers in one place so you know where you stand and can make any adjustments that are necessary to bring up your income or tone down expenses. If income exceeds expenses, you’re making a profit. In the simplest terms, how much money your business makes is the difference between how much money you bring in and how much you spend. A profit & loss (P&L) is one of the three fundamental financial documents.

0 kommentar(er)

0 kommentar(er)